By: Jerry Dilettuso on September 14th, 2012

The Value Index

Previously I’ve discussed Where Are You On the Value Grid?, a central issue that every emerging growth company must face as it works to get out of No Man’s Land: how to create a business model that enables you (and not your customers) to capture much if not most of the value you create.

Your Cholesterol

I’d like to get at this by taking a short detour: to the subject of your cholesterol.

Let’s imagine that in the year 2000 you weighed exactly what you weigh today, which is exactly what you weighed the day you graduated from high school: 162 lbs on a 5’ 11” frame.  Nonetheless, in the year 2000 your doctor diagnosed you with elevated cholesterol……not just elevated, but in the clouds elevated. Because of your weight and work-out regimen, you never paid attention to those ads warning of the dangers of high cholesterol. Your doctor, however, scared you silly when he told you high cholesterol increased the likelihood of a heart attack or stroke.

Nonetheless, in the year 2000 your doctor diagnosed you with elevated cholesterol……not just elevated, but in the clouds elevated. Because of your weight and work-out regimen, you never paid attention to those ads warning of the dangers of high cholesterol. Your doctor, however, scared you silly when he told you high cholesterol increased the likelihood of a heart attack or stroke.

So you’ve been using Lipitor ever since. Lipitor was first synthesized in 1985 and approved for use in 1996 by a company Pfizer bought in 2000. Pfizer is the world’s largest pharmaceutical company by revenue. With sales in excess of $125 billion over 14 plus years, Lipitor is the best selling drug in pharmaceutical history. Its patent didn’t expire until November 30, 2011.

Abraham Maslow tells us we homo sapiens have a hierarchy of needs of which the most basic is breathing, food, and water. One step up on the ladder is security of body and heath. So how much would you pay to reduce your risk of a heart attack or stroke? How much do you value staying alive?

I can’t tell you exactly how much we value Lipitor, but I can give you a pretty good indication. Take a look at the three boxes below:

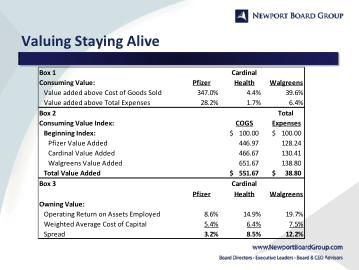

There are three companies listed: Pfizer, which makes Lipitor, Cardinal Health which distributes Lipitor, and Walgreens, which sells Lipitor. Box 1 shows how much value, in percentage terms, each of these companies added to the raw materials or goods they purchased from the other. The first row in Box 1 shows how much value was added on top of cost of goods sold and the second row shows how much value was added on top of total expenses.

Box 2 contains what I call the Value Index©. The Value index is a method to measure the value that’s created throughout the value system. So box 2 is saying for every $100 that Pfizer spent on ingredients for its prescription drugs, those drugs were sold at retail for $651.67, creating $551.67 worth of value above the ingredients’ cost. More importantly, the box is showing that for every $100 of total expenses Pfizer paid, its products sold at retail for $138.80, creating $38.80 of value.

Putting it slightly differently, Pfizer made a drug that eventually sold at retail. For every $138.80 for which it sold, all of the companies in the value system fought over $38.80 of profit. Have I captured all the value creation here…..certainly not…..but I’ll bet I’ve captured more than eighty percent of it.

Capture Profit

The lesson here is, unfortunately, you as a business owner are not alone. You exist within a value system. As a small business, you may never be able to gather sufficient data to know how much profit is available in the value system, but there is only so much profit from the ingredients at inception to the final sale, and your task is to capture as much of it as you can.

Take another look at the boxes, but now focus on Box 3. The numbers in the consuming value boxes bear no relationship whatsoever to the numbers in the owning value box, as well they shouldn’t. The objective of the consumer is to pay as little as possible, while the objective of the supplier is to charge as much as possible. Finally, isn’t it interesting that the company that has the most capital invested, Pfizer, is returning the least to its shareholders?