By: Jerry Dilettuso on October 6th, 2012

The Most Important Number for Your Business

In my experience with a multitude of companies and clients, everyone believes their business is unique. Its product or service is special. Its method of distribution is different. Its manufacturing process is distinct. Its quality is measurably superior. In a sense all these business owners are right. If they didn't have a unique selling proposition, a competitive advantage, a differentiation, they wouldn't exist.

business owners are right. If they didn't have a unique selling proposition, a competitive advantage, a differentiation, they wouldn't exist.

There is, however, one aspect of all businesses that is the same....no matter their size; no matter the industry; no matter their legal constitution. All businesses come down to a single number. It may be the difference in the business that generates the number, but the number is the final yardstick by which to evaluate any business.

The all-important number is the "spread" between the weighted average cost of capital and the return on assets. Before your eyes glaze over, stay with me here. It's important. It may well be the most important concept in all of business. It is a concept I learned during my years as an executive at PepsiCo, and it's applicable to any business. I recently used it in an engagement with a small business owner. The business operated in a small sliver within a narrow niche of a giant industry. I don't think the owner will ever look at his business in the same way again.

So how does one calculate the "spread"? It's really rather simple. Take a look at the balance sheet dated at the end of your most recent fiscal year. What are the total assets? Now, grab your income statement for the fiscal year ending the same date. Look at the income from operations and add back interest, depreciation, and amortization, if any.

OK, we're half way there. Look at your balance sheet again. Only, this time, look at the liabilities and equity side. In the liabilities section, isolate any liability on which you pay interest. Go to the equity portion, which tells you how much you have invested in the business. Note the number for total equity. Now, think about the public company that is most like yours. Go to Yahoo finance, and look up its PE ratio.

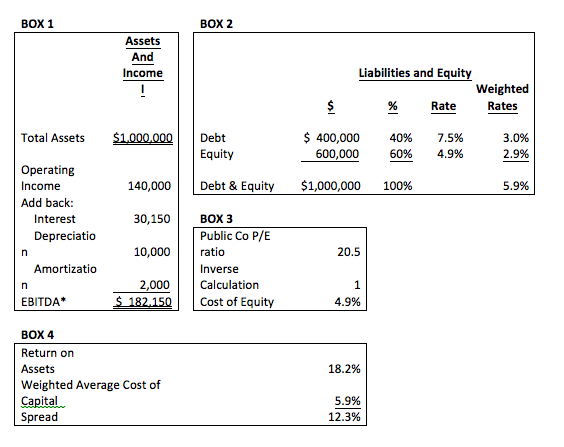

Alright, we now have enough information to do the calculation. Take a look at the table below. Box 1 contains total assets and operating income with interest, amortization, and depreciation added back (EBITDA). Box two contains the weighted average cost of the money invested in your business. Box 3 is a calculation of the cost of equity money. It’s really saying that, if instead of investing your money in your business, you invested it in a similar business in the stock market; this is what your return would be. Box 4 contains the return on assets, the weighted average cost of capital, and the “spread.”

Now, what exactly is box 4 telling us. Think of it this way. We borrowed some money at 5.9% to buy an asset, and the asset we bought is returning 18.2% to us. So we’re netting 12.3% on our asset. The asset just happens to be your business, and we’ve just calculated the single most important number to evaluate your business. There are several adjustments you can perform to make the calculation even more precise, but believe me; the method we have used is plenty good enough.

We have developed a Calculator that enables you to compute The Most Important Number for your business. Download it here. If you have any questions about how to use the Calculator or what it means for your company, contact me at Jerry.Dilettuso@NewportBoardGroup.com.