By: Catherine Cates on May 31st, 2013

5 Key Action Steps to Generate Cash for Growth

Most business owners get into business because they are passionate about their product or service and want to serve what they see as an unmet need in the market. Most want to focus on their products or customers. But instead they find themselves spending many sleepless nights worried about cash. Entrepreneurial companies with financing needs in the $200,000 to $2 million range often find themselves in the “Capital Gap” – where needs are too great to be financed with personal funds, while bank or commercial financing alternatives are complicated, expensive or unavailable. If you are caught in this “Capital Gap” here are five key actions to take to find funds to grow your business.

1. Get Your Cash Faster

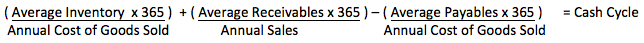

Your cash cycle is the number of days it takes for cash invested in your business to convert from working capital back to cash. This is the sum of Days Cost of Goods Sold in Inventory (or the equivalent, in the case of a service business) plus Days Sales in Accounts Receivable less Days Cost of Goods Sold in Payables.

After the recent recession, most business owners think they have this under control. But there is still room to improve. Cash should be tracked daily and these ratios reviewed weekly to understand and correct any variances. Read through the detailed receivables aging at least once a month. One CEO I know found $ 40,000 of old receivables on the books when his “reliable” senior collection manager went out on sick leave and the remaining staff was reluctant to call “the tough ones”. The newly hired CEO of a major regional hospital in Atlanta insisted on reviewing every expense check written for 60 days. All spending was visible and he quickly developed a top ten cost cutting list! With creative “out of the box” thinking, most companies can identify significant ways to improve the cash cycle, and reduce their need for financing.

2. Make Your Company “Bankable”

Clarify your value proposition so a banker can understand why customers choose to buy from your company. Make your story simple. If you have two divisions or lines of business and they are very different, break out the numbers so the trends are clear. How risky will your company look to a bank? Are you heavily reliant on one or two customers? Or on one key salesman or engineer? Emphasize the quality of your customers, your long relationships, and your experienced management team. Do your best to show a solid capital base, consistent cash flow and significant asset value to secure and repay any loans. Many companies had weak results in 2008 -2009. What changes have you made to adjust more quickly to downturns?

I will describe several other key steps in obtaining financing for growth in my next article such as putting together a professional package that explains why you need cash to grow, finding the right lender, and be creative - look at all funding sources.

Looking for more helpful information? Mark Rosenman, Founder & Chief Knowledge Officer of Newport Board Group, writes that companies should reconsider their goals, capabilities and limitations before selecting an investment banker in our complimentary whitepaper below.

Catherine Cates has a diverse background as an executive, advisor and entrepreneur. She has developed strategies for middle market companies, worked with Newport's private equity firms and has significant experience as an entrepreneur. You can learn more about Catherine or contact her here.

Catherine Cates has a diverse background as an executive, advisor and entrepreneur. She has developed strategies for middle market companies, worked with Newport's private equity firms and has significant experience as an entrepreneur. You can learn more about Catherine or contact her here.