By: Brian Kinahan on January 9th, 2014

The Problem of Leadership in Family Business Operations

In the first article in this series, I discussed a number of characteristics that make family businesses distinctive. These attributes can impart significant competitive advantage to these companies but also produce some difficult challenges.

In the first article in this series, I discussed a number of characteristics that make family businesses distinctive. These attributes can impart significant competitive advantage to these companies but also produce some difficult challenges.

For one thing, the leadership structure in a family-held business is often much more complex than in other companies. For example, a senior family member who has no formal role in the company’s board or management may still exert significant influence because of the respect and trust he or she commands with family members. This diffusion of authority can complicate decisions about the company’s direction and leadership structure especially when succession is being considered.

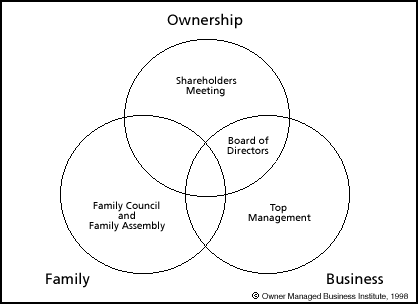

Family Business Operations: The "Three-Circle" System

One common structure for family businesses is the “three-circle” system. It calls for three types of involvement by family members who can operate at one, two or all three levels:

-

Shareholder – family or outside owners

-

Employee - including top management

-

Board Member- with or without non-family members

Structure and roles tend to evolve over time. For example, a woman who starts a business may employ her brothers and sisters, cousins, siblings and even her parents. The leadership structure of the business calls for her to run the company and maintain the principal ownership stake. Over time, non-family executives and investors may get involved in the business. However, if they are not carefully integrated with the family aspects of the company’s governance, issues can develop.

Creating a Family Council

To prevent these kinds of issues many families create a family council separate from the board of directors. It consists solely of family members who discuss and make decisions on topics related to areas in which family and business interests overlap and potentially conflict. The council’s primary goal is to give family members a voice even if they are not employees.

Examples of issues a family council might discuss and decide on are: employment of new family members, family compensation, voting rights in the business, valuation of shares, and so forth.

Most family councils include only those with an ownership stake or who are employed by the business. But some do allow participation by family members who are neither direct shareholders nor active in the business, including siblings, spouses, and in-laws.

Structural decisions like these should be carefully discussed and then documented in a family charter or constitution. The resulting governance structure may look something like this:

A Family Business Board of Directors

Unlike the Family Council, a Board of Directors in a family business generally operates the same as it would in a traditional business.

While it may include family members, the company board should concern itself primarily with the health of the business which fundamentally serves the family’s long term interests. This effective board focuses on strategic direction and risk mitigation, leaving day-to-day decisions to management. In addition, a key duty of the board is to serve as a (legal or ethical) fiduciary for share holders and stakeholders who do not have a seat on the board.

The presence and impact of the board of directors will depend on the age of the business. In the first generation most businesses are controlled by a single owner and there may not even be a board in place. The owner has voting control and makes most or all of the important decisions. A board of directors at this stage is typically made up of family members and family friends and exists primarily to satisfy legal requirements and provide some perspective.

In the second-generation, the board should take a more active role in governance. A well-functioning board focuses on protecting shareholder interests, generating policies that enable managers to reach their goals, and providing targeted feedback to senior management.

Sometimes, if too many family members are included, the board can become unwieldy and ineffective, especially if the family members aren’t fully equipped. To address this problem a family business can increases the number of highly qualified outside directors and reduce the number of less qualified family participants.

In my next article I will discuss how family businesses should approach the key priority of resolving conflicts.

Looking for additional resources for your family business? Learn how to approach capital funding to grow your business with our complimentary ebook, "How to Get and Keep Bank Credit".

About the Author

Brian Kinahan’s specialty is increasing the valuation of a business before it’s sold. He brings 35 years of C-level experience in middle market companies including 10 years as permanent Chairman, CEO or COO, plus 10 years assisting CEOs of distressed businesses and another 10 years helping CEOs of growing companies generate sustained profitable growth by upgrading business practices to match the demands of a larger enterprise. Contact or learn more about Brian here. Connect with Brian on LinkedIn

Connect with Brian on LinkedInPhoto Credit: Lugen Family Office